Last Updated on November 19, 2021

Understanding your salary slip – the pay stub

Congratulations! You’ve aced the job interview and now, after a long job search, you are finally starting to work in Israel.

There is still a lot to learn in the future; there is form 101 which needs to be filled in on your first day, overtime hours in Israel, maternity benefits, sick leave, unemployment etc. But for now you are on the payroll and anxiously awaiting your first paycheck. According to Israeli labor laws, your employer has up until the 10th of the month to pay you.

Finally payday arrives and you are presented with a Hebrew salary slip or ‘tlush maskoret’ – תלוש משכורת.

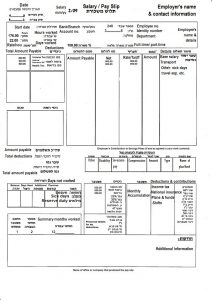

What information is included in the salary statement?

While there is no one standard format for your salary statement, according to law however, every statement needs to include the following information:

Your basic information; full name, identity number (teudat zehut), marital status, details of your bank account, if you are a full-time or part-time worker and your salary level.

Employer’s details; employer name and address, their tax registration number and their Bituach Leumi (National Insurance) file number.

Salary information; your base salary (bruto), all allowances and deductions and your net salary (netto)

Must I keep my pay slip?

Yes, your pay slip is a very important document and you need to file and keep it even though your employer has it on record.

Your pay slip is proof of your income and there are certain situations where you may need to reference the slip:-

- In case of dispute

- To get unemployment benefits

- You may also be asked to prove your salary when applying for certain reductions like school fees.

At the end of the year, which is also the end of the financial year in Israel, your employer will issue the Tax Form 106. Form 106 is a summary document reflecting your total salary for the current fiscal year as well as all income tax and National Insurance deductions (bituach leumi).

You must keep Tax Form 106 – you will need it when applying for tax refunds or reductions.

Hebrew English Salary Stub Translation

To make your Aliyah easier, we have translated a typical salary slip from Hebrew to English.